In the competitive landscape of modern markets, businesses employ various pricing strategies to attract customers, optimize revenue, and achieve market segmentation. One such strategy that has gained prominence is cash discounting with dual pricing. Businesses may adopt a cash discounting with dual pricing program to gain a competitive advantage. This approach involves considering payment processing costs and any other additional costs that might vary across different locations and markets.

This blog will delve into the concept of dual pricing, exploring its benefits, considerations, and the intricate balance that businesses must strike to effectively implement this pricing strategy.

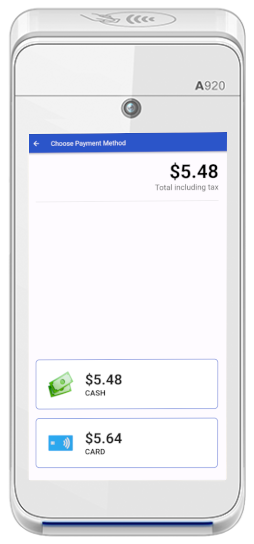

Dual pricing involves the practice of charging a reduced price (or cash discount) to customers paying with cash versus those paying with credit for the same product or service. This approach allows businesses to capitalize on the diverse preferences, willingness to pay, and purchasing behaviors exhibited by their customer base.

Dual pricing is categorized as part of cash discounting programs. A true cash discount is when a business offers a discount to customers who pay by cash, check or store-branded gift card, instead of with a credit or debit card. If you currently take credit card fees into account when pricing your businesses products and services, cash discounting is simple. Cash discounting with dual pricing allows for cash payment incentives, revenue optimization, and increased customer engagement.

This business model can be applied across new and existing markets, with the aim of capturing a wider range of customers. It’s a pricing strategy that recognizes market conditions, allowing businesses to remain competitive and potentially increase market share and revenue.

Implementing a cash discounting with dual pricing strategy can help businesses tap into new markets and attract new customers while also catering to the needs of loyal customers who value consistency and transparency in prices.

Here are five key benefits of implementing dual pricing strategies:

Cash discounting with dual pricing results in real profits that can be reinvested in your business. For example, in 2022, business owners that participated in Clearent’s cash discounting with dual pricing program were projected to save $144 million in processing fees. This breaks down to an average of $12,750 a year per business simply by sharing their processing costs with their customers.

Dual Pricing can automatically improve user experience by reducing customer confusion and friction by showing customers their savings if they decide to pay with cash. Merchants can choose the sales flow that works best for their business. They can choose to enter either the cash price or the card price.

Dual pricing strategies provide flexibility in adjusting prices based on changing market conditions, demand patterns, or competitive pressures. This adaptability in price points helps businesses remain competitive and responsive to shifts in the market.

By offering customers multiple pricing tiers, businesses can differentiate themselves from other competitors and create a unique selling proposition for customers. Premium offerings can position a business as a provider of high-quality products or services, attracting customers seeking top-notch experiences.

Dual pricing allows businesses to test various pricing strategies in different markets and gather valuable data on customer preferences and behavior. This data can inform future pricing decisions and overall business strategy.

Navigating the landscape of cash discounting compliance is a critical aspect for businesses embracing this pricing strategy. Ensuring compliance with relevant regulations and laws is essential to avoid legal complications and maintain transparent business practices.

Cash discounting with dual pricing compliance encompasses adhering to guidelines set by card networks like Visa and Mastercard, as well as federal and state laws governing surcharges, discounts, and pricing transparency.

We’ll reach out within 24 hours to schedule your demo.